Ep. 110 Blackjack, the Kelly Criterion, and the “Scientific” Approach to Investing

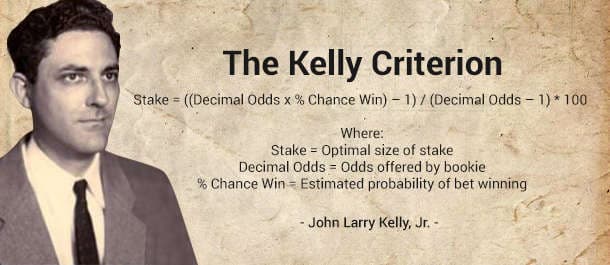

Bob discusses the famous Kelly criterion, which is a rule for capital management relevant in both gambling and investing. Bob explains the appeal of the Kelly criterion but also details how professional economists have disputed its importance. Bob illustrates the points with references to his high school Blackjack days.

Mentioned in the Episode and Other Links of Interest:

- Kelly’s original 1956 paper laying out his optimal bet sizing rule.

- A professor’s notes linking to three separate articles from 1979 in which Paul Samuelson and two others battled over the optimality of the Kelly criterion (which is equivalent to maximizing the expectation of the geometric mean of outcomes).

- The Blackjack book where high school Bob was first exposed to the Kelly criterion: The World’s Greatest Blackjack Book. #CommissionsEarned (As an Amazon Associate I earn from qualifying purchases.)

- Help support the Bob Murphy Show.

The audio production for this episode was provided by Podsworth Media.

Interesting about the Kelly criterion … but I disagree on the detail of the cultural interpretation when many people make independent bets.

Suppose N is a large number approaching infinity, and you start with $1000 in the pot. You can send 1 person to the casino who makes a $1 bet repeated 1000 times over; or you can split the pot amongst 1000 people who each goes separately to the casino and makes a $1 bet, once. Mathematically there’s no difference. Thus, if the optimal strategy is to make many small bets, then that’s also optimal for a single person. Contrariwise, if the optimal strategy is to make large bets, then splitting the pot amongst multiple people is unhelpful. Culturally, the initial action of splitting the pot (“sharing” if you prefer) might have significance to an anthropologist … but mathematically it does not change the solution to the problem.

I should point out, what I said applies only for large N. If N is a small number, then this becomes the key limitation and the entire strategy changes. Suppose N=3 for example, you start with $1000 and at most you can split the pot amongst 3 people who each only gets to make a single bet. I think in the case of small values of N then it becomes self evident that a single player making moderately large bets, and judging each bet based on the previous outcomes, will reliably beat a bunch of independent players each making a single bet.

If you want to apply this to practical situations, then the “many small bets” approach has other problems, which might be less apparent. For example, transaction costs (e.g. broker’s fees, or time spent, or accounting/compliance overheads) become significant. If you regard buying stocks, bonds, securities, etc as “betting” then your effective maximum value of N contains a hidden constraint in the form of correlation across the market. Thus you are unable to make a large number of legitimately independent bets … you end up making the same bet in multiple transactions. There was a bit of a head-scratching moment regarding Mortgage Backed Securities, where they calculated failure based on independent probabilities and concluded that the risk was miniscule … sadly then discovered that strong correlation across the entire housing market proved the risk to be vastly larger than originally anticipated.

Tel wrote: “Suppose N is a large number approaching infinity, and you start with $1000 in the pot. You can send 1 person to the casino who makes a $1 bet repeated 1000 times over; or you can split the pot amongst 1000 people who each goes separately to the casino and makes a $1 bet, once.”

Yes Tel that is fine, but you’re not correctly setting up the two strategies that are relevant. The choice is: (A) Have one person “let it ride” each time with the entire pot (whenever the deck gives the player an advantage versus the house for that hand), or (B) split the pot up among 1000 people and give them the same instructions.

Surely the Kelly criterion cannot apply to investment. The knowledge problem means that the probabilities are unknowable.