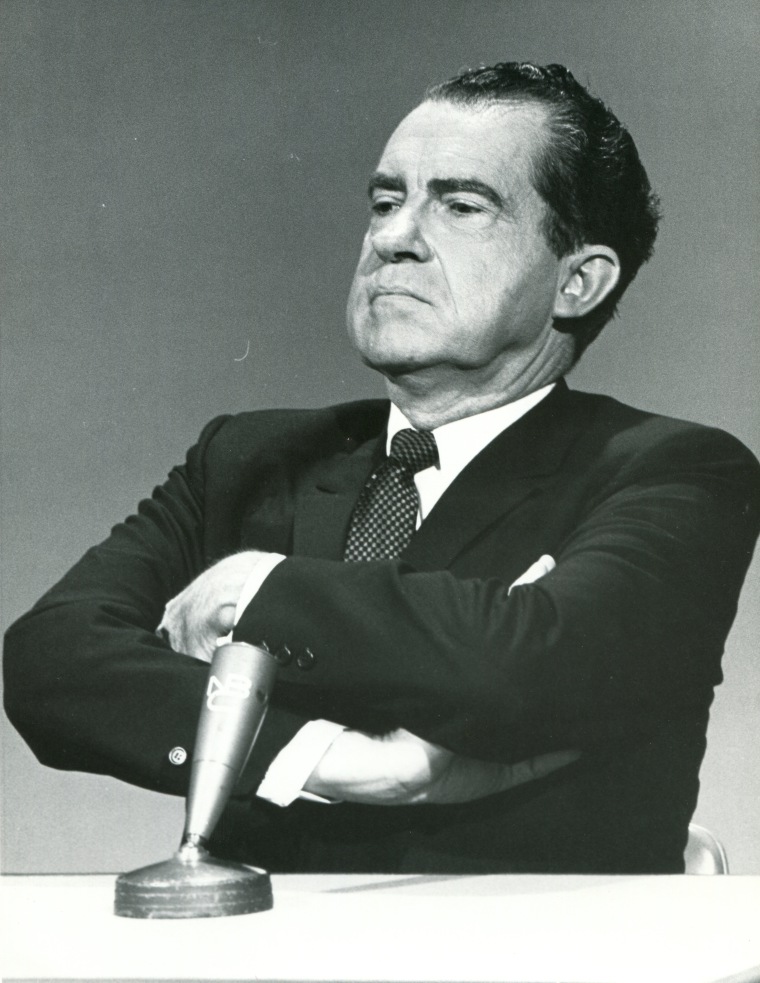

Ep. 212 The “Nixon Shock” Was Only the Final Nail in the Coffin of the Gold Dollar

Bob gives a brief history of money in the United States, explaining that the dollar was much “harder” in, say, 1810 than it was in 1910. This explains why there was significant consumer price inflation even in 1970, the year before Richard Nixon officially severed the dollar’s link to gold.

Mentioned in the Episode and Other Links of Interest:

- Bob’s chapter in the new book, Understanding Money Mechanics, discussing the history of the US gold/silver standards. His chapter on Mises’ theory of the business cycle.

- Bob’s articles discussing the 50th anniversary of Nixon closing the gold window: (1) Basic intro, (2) discussing the different regimes of the US gold standard, and (3) explaining the different inflation rates and the connection to Austrian business cycle theory. [Note that this third article hadn’t posted as of the original publication of the podcast episode; this link will be updated when available.]

- Bob’s article in the Quarterly Journal of Austrian Economics on Mises’ theory of the business cycle.

- Help support the Bob Murphy Show.

The audio production for this episode was provided by Podsworth Media.

Bob, how do you imagine an optimal money system would work in an anarcho-capitalist world? Would it be a (real) gold standard? Competing banks that might use different things (precious metals, crypto assets, other assets) as backing? If there wasn’t a government, how would the excess distribution of fiduciary media be limited or prohibited? Do you imagine it would be ruled as fraud by courts?

On the Topic of Nixon, he was less of a crook than LBJ and I do not mean that to be high praise. But in terms of the bigger issue of Gold, money, debt, and inflation … since you are putting together all this material on money and banking it would be interesting to have a review of the bits and pieces build into the various major religions with regards to such things. In particular Christianity, which you know a bit about … but if you can research other religions, that would be helpful to get it all together in one place.

Here’s the short list that I know about:

* Proverbs — “The rich rule over the poor, and the borrower is the servant of the lender” is probably older than Christianity but has been accepted by the Christians.

* Deuteronomy — seven year debt jubilee cycle.

* Commandments — no theft (7), no fraud (8), no envy (10).

* Jesus — incident with money changers in the temple.

* Lord’s Prayer — older versions required debt forgiveness, which was revised into “forgive trespass” which seems to me a rather significant alteration of meaning. I only found this recently and most people don’t know it!

* Usury — tradition of church opposition, not sure of the theological origin of this.

By the way, something else that came to mind one day … consider that the problem of the seven year debt jubilee is that lenders will compensate with higher interest rates and become increasingly reluctant to lend as the jubilee year approaches. I know they have been told never to do this … but we all know the banks won’t listen. There’s a simple answer which prevents people planning ahead … what you do is randomly trigger the jubilee year by rolling the dice once a year and figuring out something giving approximately 1 in 7 probability. This way no one knows which year is going to be a jubilee but they do know that in the long run it will average out roughly one every seven years. Take note: destruction of information … the randomizer imposes a fundamental opaqueness in the system.

Let’s go a step further and suppose we wanted to soften the pain on the lender, without going full jubilee … what we do is simply dilute the loans and shift some advantage towards the borrower. You know, one way to achieve this would be avoiding a “hard” money and therefore allowing some price inflation, which by definition is also a type of debt forgiveness. Golly, that sounds a bit like some kind of Great Reset, doesn’t it? But wait, I already know an institution that acts opaquely, depends on destruction of information, and apparently randomly imposes varying levels of price inflation onto the economy … it’s called “The Fed”. If you go and count the number of years the Fed has been in existence, then divide by the number of “surprise” recessions you get this:

Well holy schmoo it averages out to one every seven years … just like the Bible says. I’m counting 2020 as a recession year even though it was a bit unusual in economic terms. We can argue that one separately.

https://fred.stlouisfed.org/graph/fredgraph.png?g=GuVj

Q.E.D. it is proven that the Federal Reserve is doing God’s work exactly as the early Christians always intended, honk honk and tally ho!