Ep. 405 Sorry MAGA, the GDP Report Doesn’t Bode Well

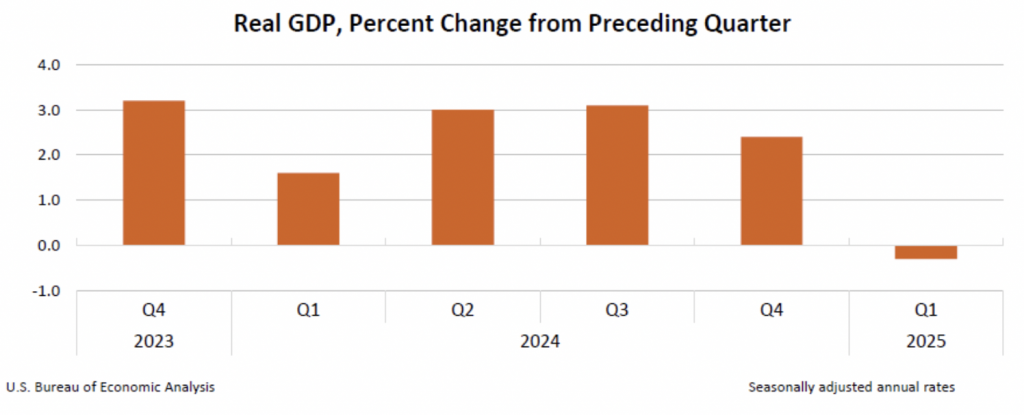

Bob analyzes the GDP report for Trump’s 1st quarter, which was characterized by a surge in imports and private inventories, and a drop in government spending. Although the conventional discussion of these topics is confused, the fall in real GDP does indeed signify a weak economy.

Mentioned in the Episode and Other Links of Interest:

- The BEA GDP report.

- Peter St. Onge’s rosy analysis.

- Bob’s article (from 2010) about quirks in the standard approach to inventory in GDP.

- The link for Monetary-Metals.com.

- Help support the Bob Murphy Show.

Out of interest, what is the reason why production (includes exports; excludes imports) within a jurisdiction is the preferred metric for the economy, rather than purchased produce (which would exclude exports and include imports)?

Maybe it would be said that as exports are largely traded for imports it doesn’t make that much difference in the long run. But if so, looking at a particular period, because the balance of trade will affect one measure positively and the other negatively, couldn’t someone like St Onge reasonably point this out? Couldn’t he sometimes say, “Yeah, this looks bad under GDP, but under gross domestic *consumption*, it doesn’t look so bad!”?

Good question Tuppenceworth, I guess for the same reason that you would say Guy A is better off financially if he has a higher income than Guy B. You wouldn’t ask how much Guy A consumed versus Guy B. Does that make sense?

Yes, maybe I follow, but I’m not sure if it is comparable. You can measure production within an economy by measuring consumption within an economy. An individual doesn’t produce goods for himself to purchase so his consumption is not equivalent to his production.

I guess, economists want to measure how much is going on within a jurisdiction but individuals trade with each other across borders; so the question is what to include and what to exclude. The choice with GDP is to include domestic goods produced for foreign consumption and exclude foreign goods produced for domestic consumption.

But some economists say “We have two equivalent ways to produce cars, grow corn and exchange it for cars or use steel to make cars”—yet only one of these supposedly interchangeable car productions is included in GDP. I was just wondering if there might be a case against this. I’m thinking the logic for GDP is that the value was added at home and that’s what we are trying to look at—“How much wealth did we generate here just now?”—so in the car example, the sale of the corn is representing that even when that wealth gets reinvested rather than buying cars straight away.